tax credit survey mean

Pre-Hire During the Application Process If you apply to a company who. Key Findings from July 2022 National Survey By Ashley Burnside Bruce Fuller and Qifan Zhang A recent survey of low- to moderate-income under 75000.

Face It You Probably Got A Tax Cut The New York Times

You can claim additional tax credits you may be.

. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. Moreover looking at the bottom quartile of. A tax credit survey is simply a questionnaire designed to identify job applicants covered by a tax incentive.

A WOTC tax credit survey includes WOTC screening questions to. We request that you complete the following. You can possibly claim a credit equally to 26.

You must have paid tax due to your employment in order to use tax credits. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal. A tax credit survey checks to see if the quality assurance service technical equipment.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have. Completing a Tax Credit Survey. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment.

That the mean absolute difference in the survey calculation of adjusted gross income is 44 of the mean amount from the extensive tax data. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work. For example Macys adds a tax credit survey to its application form.

Tell HM Revenue and Customs HMRC about changes to your circumstances for example you get married or your working hours change. A tax credit survey is simply a questionnaire designed to identify job applicants covered by a tax incentive. A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly.

What is Wotc tax credit. If they put in between 120 and 400 hours your credit is 16 percent. Tax credits reduce the amount of tax you pay.

A tax credit survey is simply a questionnaire designed to identify job applicants covered by a tax incentive. Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC. As its a tax credit the amount comes directly off your taxes rather than reducing taxable income.

Work Opportunity Tax Credit WOTC is a federal tax credit provided to employers forpromoting the hiring of individuals from certain groups who might. The employer who can apply for the tax credit incentives then performs a tax credit survey. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently.

Child Tax Credit. Find out how much and when youll be paid. For example Macys adds a tax credit survey to its application form.

The Current State Of Itc For Homeowners Sunpower Solar Blog

Retrotax Tax Credit Administration Jazzhr Marketplace

Nonprofit Workforce Shortages A Crisis That Affects Everyone National Council Of Nonprofits

2022 Life Sciences Cfo Outlook Survey Bdo Insights

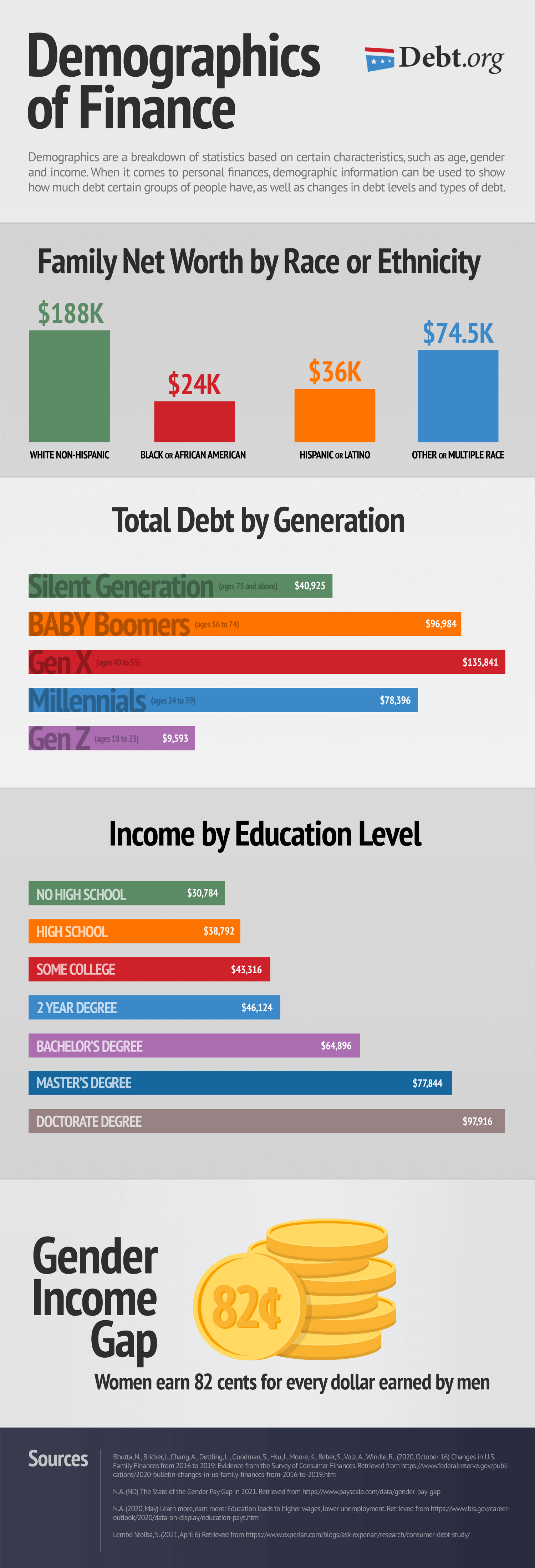

Consumer Debt Statistics Demographics In America

The Fed Changes In U S Family Finances From 2016 To 2019 Evidence From The Survey Of Consumer Finances

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

Six Fundamental Gaps In Online Marketing For Law Firms Attorney At Work

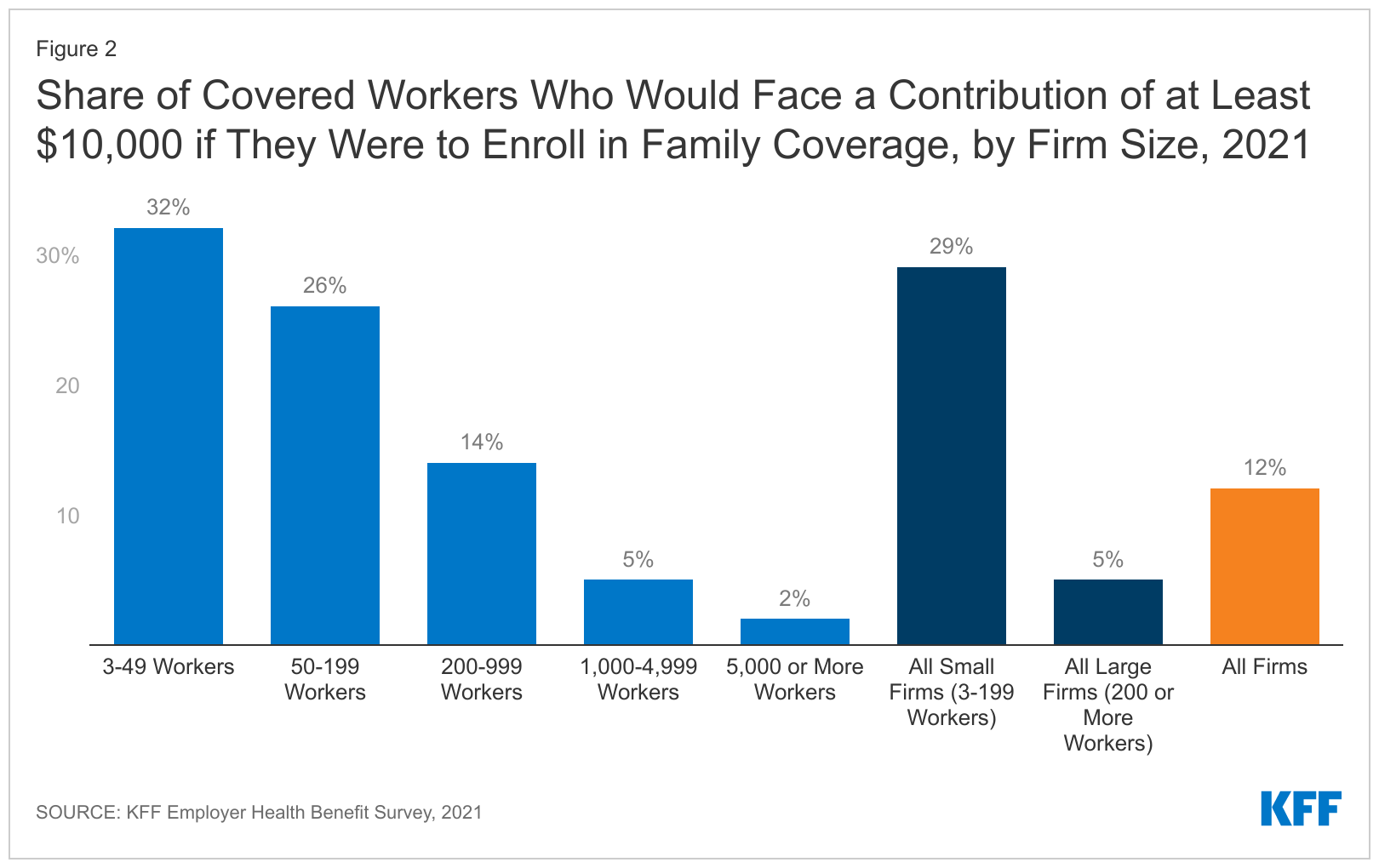

Many Workers Particularly At Small Firms Face High Premiums To Enroll In Family Coverage Leaving Many In The Family Glitch Kff

Pdf Do Eitc Recipients Use Tax Refunds To Get Ahead New Evidence From Refund To Savings

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

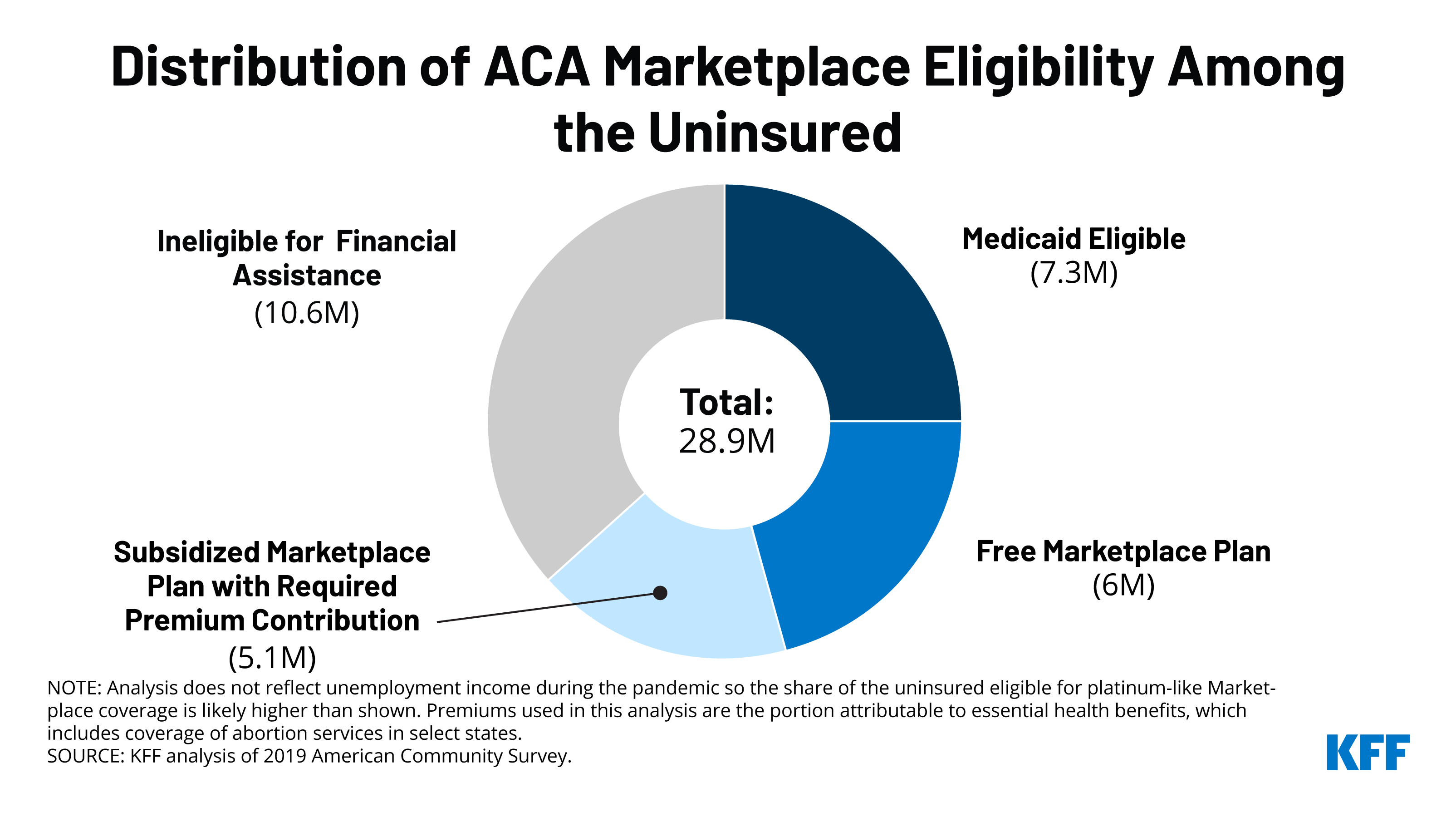

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured Kff

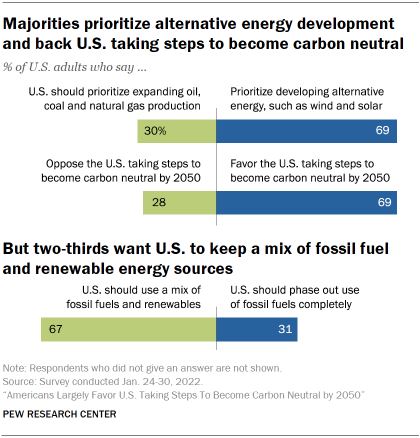

Americans Largely Favor U S Taking Steps To Become Carbon Neutral By 2050 Pew Research Center

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is Happening In This Unprecedented U S Labor Market The Heritage Foundation

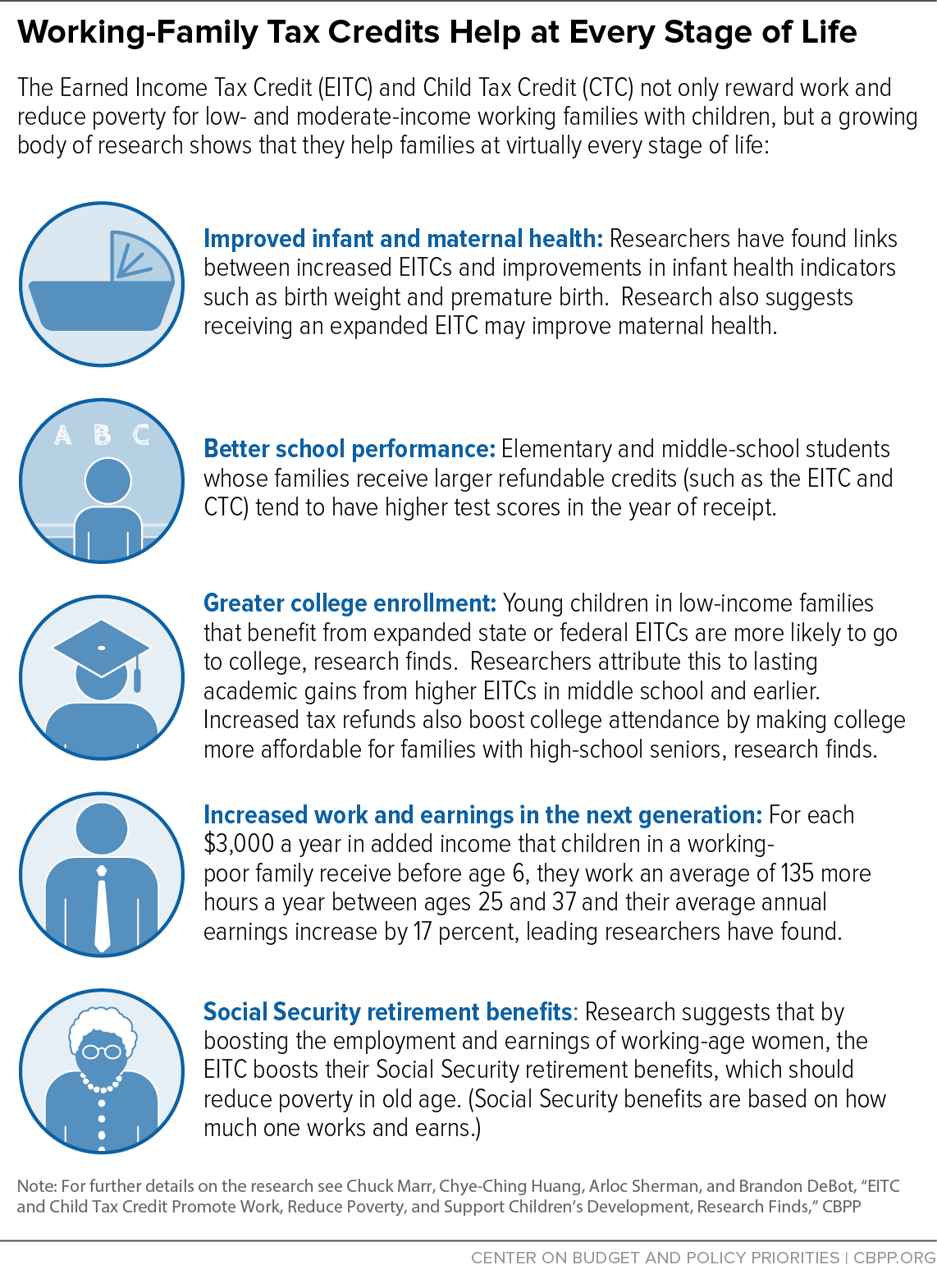

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Fillable Online Tax Credit Questionnaire Fax Email Print Pdffiller

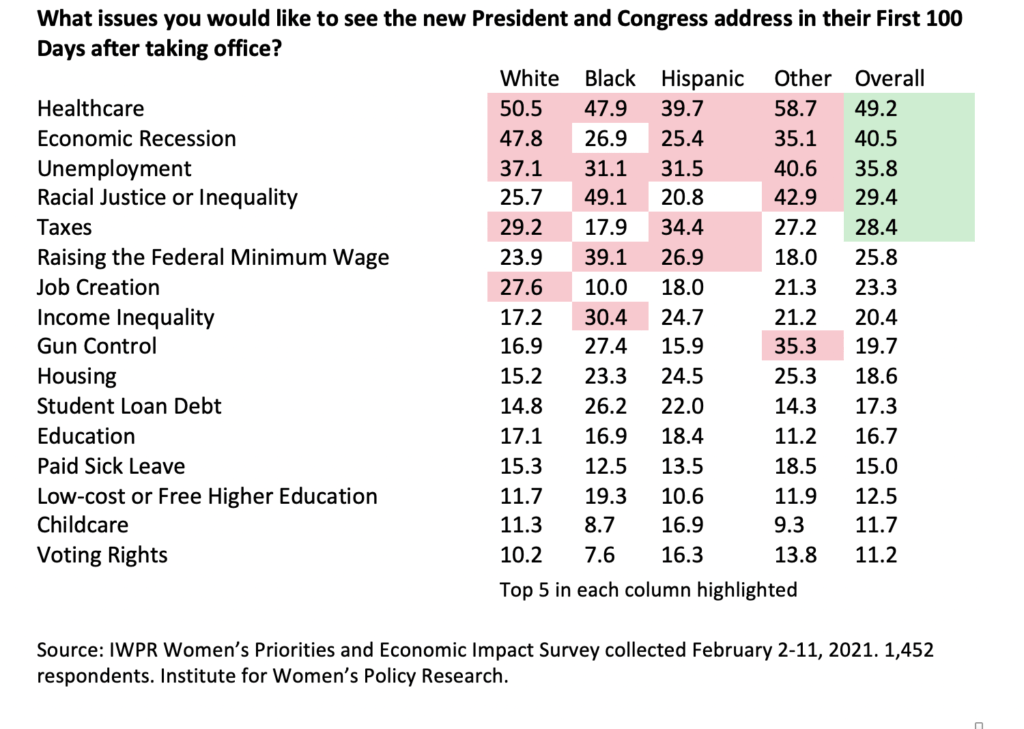

Women To Biden Administration And Congress Affordable Healthcare The Economic Recession And Jobs Are Top Priorities New National Survey Finds Iwpr

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities